Sample Schedule B . You had over $1,500 of taxable interest or ordinary dividends. — subscribe to our youtube channel: Brought to you by businessaccountant.com. You had over $1,500 of taxable interest or ordinary dividends. — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. — schedule b is an irs tax form that must be completed if a taxpayer receives interest income and/or ordinary dividends of more than $1,500 during. — a step by step example of how to fill out a simple schedule b (form 1040). use schedule b (form 1040) if any of the following applies. use schedule b (form 1040) if any of the following applies:

from www.youtube.com

— schedule b is an irs tax form that must be completed if a taxpayer receives interest income and/or ordinary dividends of more than $1,500 during. use schedule b (form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. — a step by step example of how to fill out a simple schedule b (form 1040). — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. Brought to you by businessaccountant.com. use schedule b (form 1040) if any of the following applies. — subscribe to our youtube channel: You had over $1,500 of taxable interest or ordinary dividends.

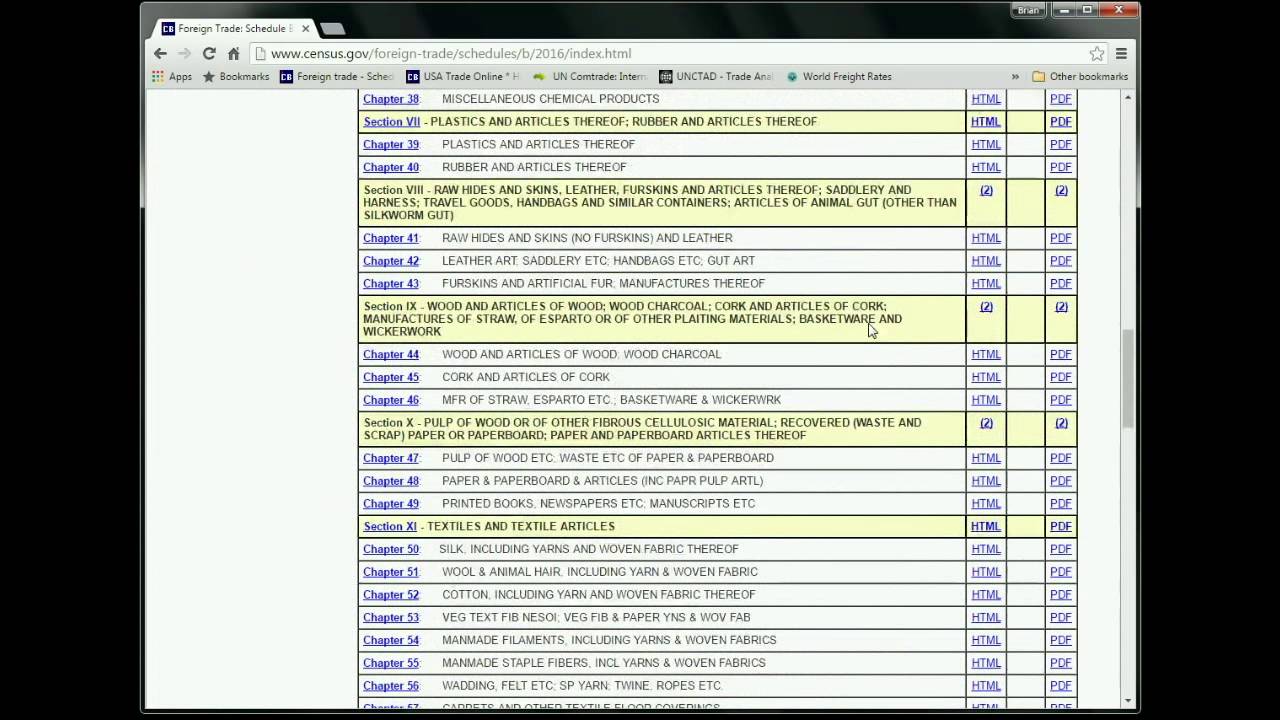

Lesson 1 Identifying the Schedule B number for exporting your products YouTube

Sample Schedule B — a step by step example of how to fill out a simple schedule b (form 1040). You had over $1,500 of taxable interest or ordinary dividends. — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. — schedule b is an irs tax form that must be completed if a taxpayer receives interest income and/or ordinary dividends of more than $1,500 during. Brought to you by businessaccountant.com. — a step by step example of how to fill out a simple schedule b (form 1040). — subscribe to our youtube channel: You had over $1,500 of taxable interest or ordinary dividends. use schedule b (form 1040) if any of the following applies: use schedule b (form 1040) if any of the following applies.

From www.formsbank.com

Fillable Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule Depositors Sample Schedule B — a step by step example of how to fill out a simple schedule b (form 1040). — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. — subscribe to our youtube channel: Brought to you by businessaccountant.com. You had over $1,500 of taxable interest or ordinary. Sample Schedule B.

From form-8916-a.com

form 1120 schedule b instructions 2017 Fill Online, Printable, Fillable Blank Sample Schedule B — a step by step example of how to fill out a simple schedule b (form 1040). — subscribe to our youtube channel: You had over $1,500 of taxable interest or ordinary dividends. — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. Brought to you by. Sample Schedule B.

From www.quesba.com

An individual must complete Schedule B (Forms 1040A or 1040)...ask 1 Sample Schedule B — a step by step example of how to fill out a simple schedule b (form 1040). You had over $1,500 of taxable interest or ordinary dividends. use schedule b (form 1040) if any of the following applies: Brought to you by businessaccountant.com. You had over $1,500 of taxable interest or ordinary dividends. — when a taxpayer. Sample Schedule B.

From printableformsfree.com

Free Fillable Form Schedule B Printable Forms Free Online Sample Schedule B You had over $1,500 of taxable interest or ordinary dividends. Brought to you by businessaccountant.com. — a step by step example of how to fill out a simple schedule b (form 1040). — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. You had over $1,500 of taxable. Sample Schedule B.

From www.templateroller.com

Download Instructions for IRS Form 1116 Schedule B Foreign Tax Carryover Reconciliation Schedule Sample Schedule B Brought to you by businessaccountant.com. You had over $1,500 of taxable interest or ordinary dividends. You had over $1,500 of taxable interest or ordinary dividends. — schedule b is an irs tax form that must be completed if a taxpayer receives interest income and/or ordinary dividends of more than $1,500 during. use schedule b (form 1040) if any. Sample Schedule B.

From printableformsfree.com

Schedule B Form 941 For 2023 Printable Forms Free Online Sample Schedule B use schedule b (form 1040) if any of the following applies. — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. — schedule b is an irs tax form that must be completed if a taxpayer receives interest income and/or ordinary dividends of more than $1,500 during.. Sample Schedule B.

From form-941-schedule-b.com

Schedule B 941 Create A Digital Sample in PDF Sample Schedule B You had over $1,500 of taxable interest or ordinary dividends. — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. — subscribe to our youtube channel: use schedule b (form 1040) if any of the following applies. — a step by step example of how to. Sample Schedule B.

From www.formsbank.com

Form Tc65 Schedule B Apportionment Schedule printable pdf download Sample Schedule B — schedule b is an irs tax form that must be completed if a taxpayer receives interest income and/or ordinary dividends of more than $1,500 during. — subscribe to our youtube channel: — a step by step example of how to fill out a simple schedule b (form 1040). You had over $1,500 of taxable interest or. Sample Schedule B.

From www.slideserve.com

PPT Fiscal Year 2019 Fiscal & Compliance (AUP) Audit Schedule B Preparation Sample Schedule B — a step by step example of how to fill out a simple schedule b (form 1040). You had over $1,500 of taxable interest or ordinary dividends. — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. use schedule b (form 1040) if any of the following. Sample Schedule B.

From www.jwcc.edu

Sample Schedules JWCC Sample Schedule B use schedule b (form 1040) if any of the following applies: use schedule b (form 1040) if any of the following applies. — a step by step example of how to fill out a simple schedule b (form 1040). Brought to you by businessaccountant.com. — subscribe to our youtube channel: You had over $1,500 of taxable. Sample Schedule B.

From www.youtube.com

Schedule B (Form 1040) YouTube Sample Schedule B — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. Brought to you by businessaccountant.com. — schedule b is an irs tax form that must be completed if a taxpayer receives interest income and/or ordinary dividends of more than $1,500 during. — subscribe to our youtube channel:. Sample Schedule B.

From www.slideshare.net

Form 1040, Schedules A & BItemized Deductions & Interest and Dividen… Sample Schedule B You had over $1,500 of taxable interest or ordinary dividends. You had over $1,500 of taxable interest or ordinary dividends. — schedule b is an irs tax form that must be completed if a taxpayer receives interest income and/or ordinary dividends of more than $1,500 during. Brought to you by businessaccountant.com. — when a taxpayer files their form. Sample Schedule B.

From www.census.gov

How to Find Your Schedule B Number Revisited Sample Schedule B — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. You had over $1,500 of taxable interest or ordinary dividends. use schedule b (form 1040) if any of the following applies. — a step by step example of how to fill out a simple schedule b (form. Sample Schedule B.

From www.youtube.com

Lesson 1 Identifying the Schedule B number for exporting your products YouTube Sample Schedule B You had over $1,500 of taxable interest or ordinary dividends. — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. use schedule b (form 1040) if any of the following applies. Brought to you by businessaccountant.com. use schedule b (form 1040) if any of the following applies:. Sample Schedule B.

From es.slideshare.net

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul… Sample Schedule B You had over $1,500 of taxable interest or ordinary dividends. — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. use schedule b (form 1040) if any of the following applies: — schedule b is an irs tax form that must be completed if a taxpayer receives. Sample Schedule B.

From marthacmorgan.github.io

941 Schedule B 2022 Sample Schedule B Brought to you by businessaccountant.com. — schedule b is an irs tax form that must be completed if a taxpayer receives interest income and/or ordinary dividends of more than $1,500 during. use schedule b (form 1040) if any of the following applies: — when a taxpayer files their form 1040, they should attach a schedule b to. Sample Schedule B.

From printableformsfree.com

Irs Form 941schedule B Printable Printable Forms Free Online Sample Schedule B — when a taxpayer files their form 1040, they should attach a schedule b to report interest income, dividend income,. — a step by step example of how to fill out a simple schedule b (form 1040). use schedule b (form 1040) if any of the following applies. use schedule b (form 1040) if any of. Sample Schedule B.

From printableformsfree.com

941 Form 2023 Schedule B Form Printable Forms Free Online Sample Schedule B You had over $1,500 of taxable interest or ordinary dividends. — a step by step example of how to fill out a simple schedule b (form 1040). use schedule b (form 1040) if any of the following applies: Brought to you by businessaccountant.com. You had over $1,500 of taxable interest or ordinary dividends. — subscribe to our. Sample Schedule B.